Falling into debt can be stressful, as is the worry that your debts may be sent to collection. A collection account can occur when a creditor places your account with a third-party collection agency or when your account is sold to a debt buyer.

It’s important to know what a collection account is and why you should pay off a collection account. In this guide, we’ll walk you through the typical debt collection process so you can be prepared should your debt end up in collections.

- What Does It Mean When Debt Is Sent to Collections?

- What Is the Difference Between a Collection Account and a Charge-Off?

- How Does the Debt Collection Process Work?

- What Are the Benefits of Paying Off Collection Accounts?

- Key Takeaways: What Is a Collection Account?

What Does It Mean When Debt Is Sent to Collections?

A collection account occurs when a borrower fails to make payments on the account and the creditor sends the account to a collection agency. A collection account can also occur if the creditor sells the account to a debt buyer. Being placed into collections occurs if the borrower is late on their payments, known as being delinquent. Once delinquent, if the account remains unpaid, it is at risk of becoming a charge-off. A charge-off is when an account is written off as uncollectible.

Creditors take this course of action in an attempt to recover some or all of the debt a borrower owes. Having an account sent to collections is considered a derogatory on a credit report. It’s important to note that whether or not your account has been sold the debt is generally still legally collectible. This is why staying motivated to pay off your debt is crucial.

What Is the Difference Between a Collection Account and a Charge-Off?

If you’re a borrower who falls into debt, you may come across various terms, such as collection account and charge-off. We know that a collection account occurs when a delinquent account is placed with a third-party who seeks payment on the account. A charge-off is a specific type of delinquency when a creditor writes the account off, considering it a loss. Charge-offs occur when creditors believe the debt likely won’t be repaid, and a charged-off account can be sold to a debt buyer.

Regardless of whether you have a collection account or a charge-off, it’s important to take control of your debt.

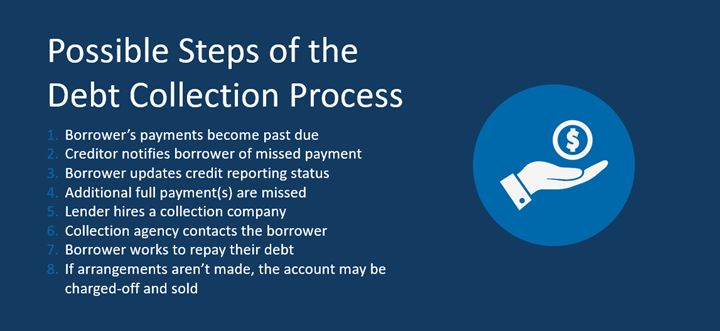

How Does the Debt Collection Process Work?

Now that you understand what a collection account is, you may be wondering how the debt collection process works. The debt collection process can vary by lender, the type of debt, location of the consumer, or other factors, but in general you can expect the following process:

- Borrower’s payments become past due: In order to end up with a collection account, a borrower first needs to become delinquent, in other words past due, on their loan. This occurs when they fail to make payments on time or do not pay the minimum payment due.

- Creditor notifies borrower of missed payment: After a borrower falls behind on payments, the lender will inform the borrower that they did not receive the minimum payment due. This could be a letter, email, and/or call. They may also alert you on your periodic statement.

- Borrower updates credit reporting status: After a payment is missed, a creditor may notify one or all of the three national credit reporting bureaus that the payment was missed.

- Additional full payment(s) are missed: However, if payments continue to be missed, more letters may be sent indicating further action, such as charging interest, fees, or even suspending your account.

- Lender hires a collection company: After continuously failed payments, a lender may hire a third-party collection agency that specializes in servicing delinquent accounts.

- Collection agency contacts the borrower: When hired, a debt collection company will notify the borrower that they are servicing the account. They will attempt to contact the borrower to verify their identity and outline the steps that will be taken to bring the account current or to resolve the past due balance.

- Borrower works to repay their debt: The borrower can work with the debt collection company to create a repayment plan that helps them repay their debt.

- If arrangements aren’t made, the account may be charged-off and sold: In some instances, the account becomes so delinquent that the lender charges-off the account as the likelihood of receiving payment is low. After the account is charged-off, the account may be sold to a debt buyer. Debt buyers specialize in servicing accounts that have gone months without making payments by offering repayment plans, sometimes with no interest or fees.

What Are the Benefits of Paying Off Collection Accounts?

Because collection accounts can be reported to credit bureaus, it’s helpful to a lot of people to create a budget and a plan to pay off debt. With that said, there are several benefits of paying off collection accounts. Some benefits of resolving your debt include:

- Avoid lawsuits: In many circumstances, if you have debt within the statute of limitations, which varies by state and type of debt, the creditor may be able to sue you in a local court. In some cases, those who are sued may be responsible for reasonable court costs and even interest could be awarded from date of delinquency.

- Stop collection calls and notices: Having a collection account can result in frequent contact coming from the debt collector. Paying off your collection account can permanently stop the debt collection company from calling you and sending notices in the mail on that account.

Key Takeaways: What Is a Collection Account?

A collection account occurs when a borrower fails to repay their debt and the original creditor either sends it to a third-party collection agency to recover the unpaid balance or the creditor sells it to a third-party collection agency. A collection account is considered to be a derogatory item on a credit report, which is why a lot of people believe it is important to resolve collection accounts. At Midland Credit Management, we work with our consumers by creating a repayment plan that works for their financial situation. Learn more by contacting us today.